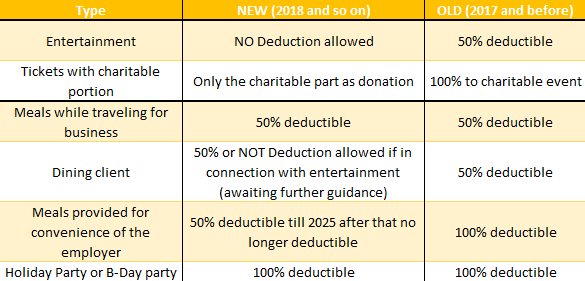

Here are some examples to help you understand what is and what isn’t deductible.

Cost of a package that includes a ticket to a charity gala event. – The charitable portion is still deductible, rest is considered entertainment and will not be deducted.

Show ticket – Going to WVC in Las Vegas it’s always fun. Hope you didn’s spent too much, this year on a show ticket because the ticket will not be deductible.

Meals at Fetch in Virginia Beach will be still 50% deductible for your employees if you have a reimbursement plan in place or if they are using company card.

Snacks at the open house – This should qualify as a 100% deductible since it is made available to the general public. If promoting clinic or sale of dental or other services, this could be deducted as advertising.

Meals at the rotary club meeting – meals to attend business meetings are remaining 50% deductible.

Membership dues for the Rotary Club, Chamber of Commerce – The law says: No deduction is allowed for the membership in any club organized for business, pleasure, recreation or other social purposes. Those club dues seem to be non-deductible.

Office party – The Best Tech celebration will still be fully deductible.

Bottled water and snacks on hand for customers – This should be fully deductible (unless it’s meant for employees as well. Still waiting for further guidance on these types of snacks.